The United Arab Emirates is undergoing a major digital transformation in its tax and invoicing infrastructure. With the nationwide rollout of UAE E-Invoicing starting July 2026, businesses across the UAE must prepare for a new era of automated, secure, and standardized invoice exchange. At the core of this transformation is the adoption of the OpenPeppol framework and the Decentralized Continuous Transaction Control and Exchange (DCTCE) model, widely known as the 5-Corner Model.

This comprehensive guide provides a detailed understanding of the UAE’s e-invoicing system, including visual diagrams and clear explanations of the four major global models—Real-Time Reporting, Clearance, Centralized Exchange, and the Decentralized 5-Corner Model. It also explores how OpenPeppol enables interoperability and compliance across borders, and what businesses need to do to align with the Federal Tax Authority (FTA) requirements.

Whether you’re a large enterprise or an SME, this blog will help you navigate the upcoming changes, understand the technical and regulatory landscape, and prepare your systems for seamless integration with UAE’s e-invoicing ecosystem.

What is OpenPeppol?

OpenPeppol is a non-profit organization that governs the Peppol (Pan-European Public Procurement Online) framework. Originally developed in Europe, Peppol has become a global standard for electronic document exchange, including invoices, purchase orders, and credit notes. It ensures:

- Interoperability across systems and borders

- Standardization of formats (UBL/XML)

- Secure connectivity via certified Access Points

- Governance and compliance through a unified legal framework

The UAE has adopted Peppol-PINT AE, a localized version of the Peppol standard, tailored to meet the country’s tax and regulatory requirements.

Evolution of E-Invoicing Models

Globally, e-invoicing has evolved from Periodic Transaction Controls (PCT) to Continuous Transaction Controls (CTC). The UAE’s model is a decentralized CTC system, which balances government oversight with business automation.

Key Models in E-Invoicing:

Key Models in E-Invoicing:

- Real-Time Reporting Model

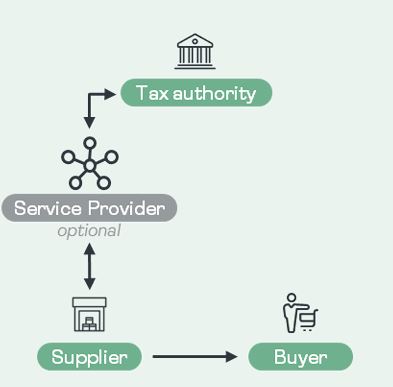

Diagram 1 – Real-Time Reporting Model

In the real-time reporting model, businesses are required to submit invoice data to the tax authority or a designated government platform shortly after the invoice is issued and exchanged between trading partners. This submission happens almost immediately, ensuring that the tax authority has access to transaction data in near real-time. The primary goal of this model is to enhance transparency and reduce the risk of tax evasion by enabling quicker detection of irregularities. While the invoice itself is exchanged directly between the buyer and seller, the tax authority receives a copy of the data soon after issuance, allowing for timely monitoring and analysis.

- Clearance Model

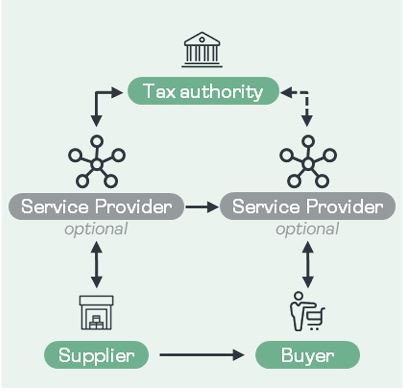

Diagram 2 – Clearance Model

The clearance model introduces a layer of control where invoices must be validated by the tax authority before they are sent to the buyer. This model can be implemented in different configurations. In a pre-clearance setup, the invoice is submitted to the platform first, and only after approval is it forwarded to the recipient. In contrast, post-clearance involves sending the invoice to the buyer first, followed by submission to the tax authority. Additionally, the model can operate in simplex or duplex modes. The simplex mode requires only the issuer to report the invoice, whereas the duplex mode involves both the issuer and the recipient uploading the invoice to the platform. This model ensures strong compliance and reduces the risk of fraudulent transactions, but it may introduce delays in the invoice exchange process.

- Centralized Exchange Model

Diagram 3 – Centralized Exchange Model

The centralized exchange model relies on a central platform that facilitates the transmission of electronic invoices between buyers and sellers. This platform also incorporates tax reporting functionalities, making it suitable for both business-to-government (B2G) and business-to-business (B2B) transactions. Vendors can submit their invoices to the central exchange using various methods such as direct upload, API integration, email, or through third-party service providers. Once received, the platform performs a series of checks to validate the invoice format, ensure compliance with tax regulations, and verify adherence to business rules. After successful validation, the invoice is delivered to the buyer, who can access it through the platform or via their service provider. This model centralizes control and simplifies compliance but may create a single point of dependency.

- Decentralized Continuous Transaction Control and Exchange Model (DCTCE) or 5 Corner Model

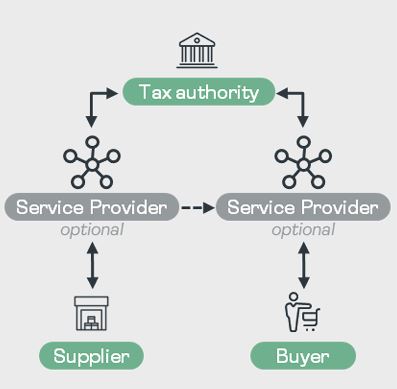

Diagram 3 – Centralized Exchange Model

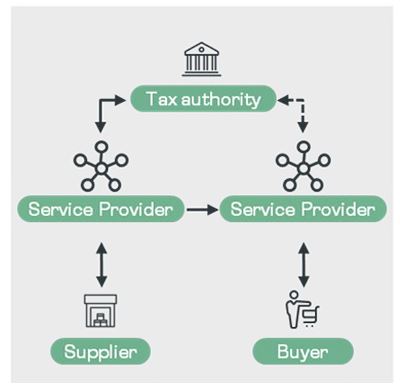

The decentralized Continuous Transaction Control (CTC) and exchange model, commonly referred to as the 5-Corner Model, represents a forward-thinking approach to e-invoicing that aligns the compliance needs of tax authorities with the operational efficiencies sought by businesses. Unlike traditional models that rely on centralized platforms or direct tax authority clearance, this model delegates the validation and exchange of invoice data to certified service providers. These providers must meet stringent technical and financial criteria to ensure reliability and security.

In this framework, the flow of invoices is managed through standardized interoperability protocols between service providers, while only a subset of invoice data is reported to the central tax authority platform. This reporting occurs immediately after the invoice is issued, enabling a seamless and uninterrupted trade cycle. Both sellers and buyers interact with their respective service providers through a single interface, allowing them to retain their existing systems and automation tools without disruption.

How the 5 corner model works? Components of 5 Corner model

Corner 5 – Federal Tax Authority (FTA) and Ministry of Finance (MoF) : Receives a specific subset of invoice data for compliance and audit purposes.

Corner 1 – Supplier: The business entity that issues the invoice.

Corner 2 – Supplier’s Accredited Service Provider (ASP): Responsible for validating and transmitting the invoice to the buyer’s service provider and reporting relevant data to the tax authority.

Corner 3 – Buyer’s ASP: Receives the validated invoice and forwards it to the buyer.

Corner 4 – Buyer: The recipient of the invoice who processes it through their chosen service provider.

Corner 5 – Federal Tax Authority (FTA) and Ministry of Finance (MoF) : Receives a specific subset of invoice data for compliance and audit purposes.

What are the benefits of the 5 Corner Model?

The 5-Corner Model offers a range of strategic and operational advantages that make it an ideal framework for modern e-invoicing systems, especially in digitally progressive economies like the UAE:

- Modular Deployment: One of the key strengths of the model is its flexibility in implementation. Businesses and governments can roll out the system in phases, starting with mandatory B2B and B2G document exchanges. Once these flows are stabilized, the reporting connection between certified service providers and the central tax platform can be added with minimal disruption to existing business processes.

- Customizable Tax Control: The model supports jurisdiction-specific tax reporting requirements. Whether a country needs different invoice data sets or additional trade cycle documents, only a relevant subset of the invoice is extracted and shared. This ensures data confidentiality and minimizes exposure, while also allowing tax authorities to update their requirements without impacting businesses directly—since certified service providers handle the data extraction.

- SME-Friendly Design: Recognizing the importance of small and medium-sized enterprises (SMEs), the model includes provisions for low-cost or free services. Certified service providers are often required to offer complimentary access for a limited number of invoices (e.g., up to 50 annually), depending on the size of the business. This ensures that smaller companies can participate in the e-invoicing ecosystem without incurring significant costs.

- No Single Point of Failure: Unlike centralized models, the 5-Corner Model decentralizes the exchange of business documents. The central tax platform receives only a minimal, validated data set, reducing its operational burden. This architecture enhances system resilience, as the core exchange happens between certified service providers, ensuring continuity even if one node experiences downtime.

Final Thoughts

As the UAE moves toward full-scale implementation of its national e-invoicing system, the adoption of the 5-Corner Model marks a significant milestone in the region’s digital transformation journey. By leveraging the OpenPeppol framework and a decentralized, service-provider-driven architecture, the UAE is setting a global benchmark for secure, scalable, and business-friendly e-invoicing.

This model not only enhances tax compliance and data transparency but also empowers businesses—especially SMEs—to streamline operations and reduce administrative overhead. Its modular design, customizable reporting, and resilience against system failures make it a future-proof solution for both domestic and cross-border trade.

For companies operating in the UAE, understanding and preparing for this shift is essential. Early adoption will not only ensure regulatory compliance but also unlock operational efficiencies and competitive advantages in a rapidly digitizing economy. The 5-Corner Model isn’t just a technical upgrade—it’s a strategic enabler for smarter, faster, and more secure business transactions in the UAE and beyond.

FAQs: UAE E-Invoicing and the 5-Corner Model

1. What is the UAE’s 5-Corner Model for e-invoicing?

The UAE’s e-invoicing system is built on the Decentralized Continuous Transaction Control and Exchange (DCTCE) model, also known as the 5-Corner Model. It involves five key participants: the supplier, supplier’s service provider, buyer’s service provider, buyer, and the Federal Tax Authority (FTA). This model ensures secure, real-time invoice exchange and compliance reporting through certified service providers.

2. When will e-invoicing become mandatory in the UAE?

The UAE will implement e-invoicing in phases:

- July 1, 2026: Voluntary pilot program begins.

- January 1, 2027: Mandatory for businesses with annual revenue ≥ AED 50 million.

- July 1, 2027: Mandatory for businesses with revenue < AED 50 million.

- October 1, 2027: Mandatory for government entities.

3. What formats are accepted for e-invoices in the UAE?

Only structured digital formats such as XML or JSON are accepted. These must comply with standards like UBL (Universal Business Language) or PINT AE (Peppol Invoice Standard for UAE). Formats like PDF, Word, or scanned images are not valid under the UAE e-invoicing regulations

4. Do SMEs need to appoint an Accredited Service Provider (ASP)?

Yes, all VAT-registered businesses—including SMEs—must appoint a UAE-accredited service provider to issue and receive e-invoices. However, the system is designed to be SME-friendly, with low-cost or free services available for smaller businesses, especially those issuing fewer than 50 invoices annually

5. How does Peppol integration benefit UAE businesses?

Peppol enables interoperable, secure, and standardized invoice exchange across borders. For UAE businesses, this means:

- Seamless B2B and B2G transactions

- Real-time compliance with FTA regulations

- Reduced manual errors and faster processing

- Enhanced data security and fraud prevention

6. What happens if a business fails to comply with UAE e-invoicing rules?

Non-compliance can lead to:

- Invoice rejection by customers or government entities

- VAT recovery issues

- Penalties under UAE VAT law

- Disrupted cash flow due to delayed processing It’s essential for businesses to prepare early and ensure their systems are integrated with an accredited ASP

Monish Mohan is a versatile and accomplished Auditor, VAT Consultant, Finance and Accounts Professional offering over 18 years of experience in UAE VAT, Audit & Assurance, Finance management Advisory & Accounting & bookkeeping.